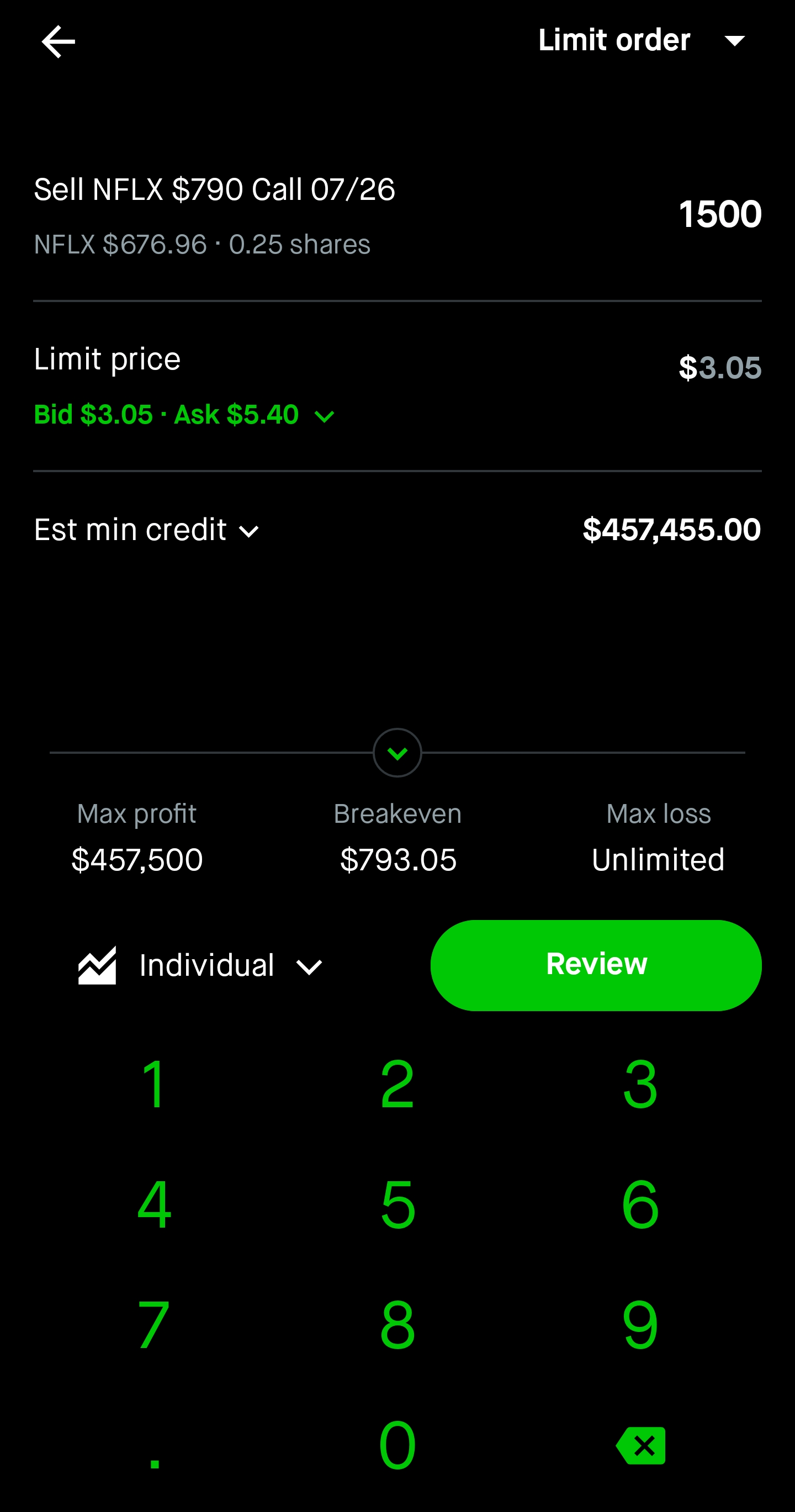

I've bought a couple call options before, and I think I get how that works… But I'm not understanding selling calls. Why wouldn't I want to sell a call that has a strike price that's almost guaranteed to never hit and just pocket the premium? What am I missing here?

https://i.redd.it/1tr89qor719d1.png

Posted by chaserjj

33 Comments

Unless you’re able to sell naked calls you’re going to have to own 100 shares of the underlying stock (or a longer term lower strike call option like a leap). Either way you’re going to have to have some capital. But yeah you just described the purpose of doing a buy/write: sell a call at a strike you don’t think will hit and keep the premium

Sell calls on the .25 shares that you have ? 😂

Nobody’s buying pal

https://preview.redd.it/rrxm49hs819d1.jpeg?width=1161&format=pjpg&auto=webp&s=56cdedfa4a5c660beb350786a36980a011f06958

there are regards who get assigned and post here

brother you’re about to feel max pain focus

Hopefully Robinhoods many safe guards.

Because someone has to buy it.

Selling naked OTM calls is like picking up pennies in front of a steamroller. The premium won’t be high, but all it takes is 1 time for price to skyrocket and you will pay back everything you’ve ever made plus multitudes more.

Just watch what is written under “Max Loss”

Wendy’s shift starts soon huh

790 is only like 15% up from here. I don’t think I’d call that ridiculous and definitely wouldn’t say it could never hit. Especially with earnings before that expiration

I consistently roll strangles and collect premium. I look for weekly .10¢ spreads to sell 100 calls and 100 puts. 95+ % of profit each week nets me $2000/ week. It’s very lucrative if you’re patient……

But when it goes against you, better cover quickly, roll, or close out and take the l.

It works until it doesn’t. When it doesn’t, some people jump of high things.

>What am I missing here?

About 150000 shares and the possibility of bankruptcy.

They are not fucking around when they say max loss is unlimited. Be ready to delete the app.

Can you read the part that says Max Loss Unlimited?

Imagine naked RIVN call sellers today

​

eom

You need 150,000 shares of Netflix. At its current price you would need 100 million dollars. You can do a poor man’s covered call but that also takes more money.

https://preview.redd.it/n9lpsrk8r19d1.png?width=1440&format=png&auto=webp&s=b27512450a40167292d57f21d6acd64356a0cd55

It’s guaranteed to never hit until it does

OP has the short bus all to itself

Your margin limits.

This guy wants a math assignment from his teacher

Bro can’t afford 1 share and wants to sell a half mil worth of calls only 16% OTM

You don’t have the money to do this

And some say that this sub has lost its charm.

Margin requirements.

Do you have 150k shares of Netflix to cover in case you get assigned? Cuz might as well start pricing your organs out

“Almost guaranteed.” Fortunes have been lost and lives ruined thanks to those exact words.

Nothing go for it

You won’t be able to sell those calls, that’s what is stopping you.

You don’t have the ability to sell naked calls, nor do you have 150,000 shares to cover those calls you want to sell.

Buy 150,000 shares first and then you can sell those calls if you want.

Find out for us.