I want to share this sheet I created to monitor assignment risk.

Please, feel free to comment on any mistakes or improvements

Description:

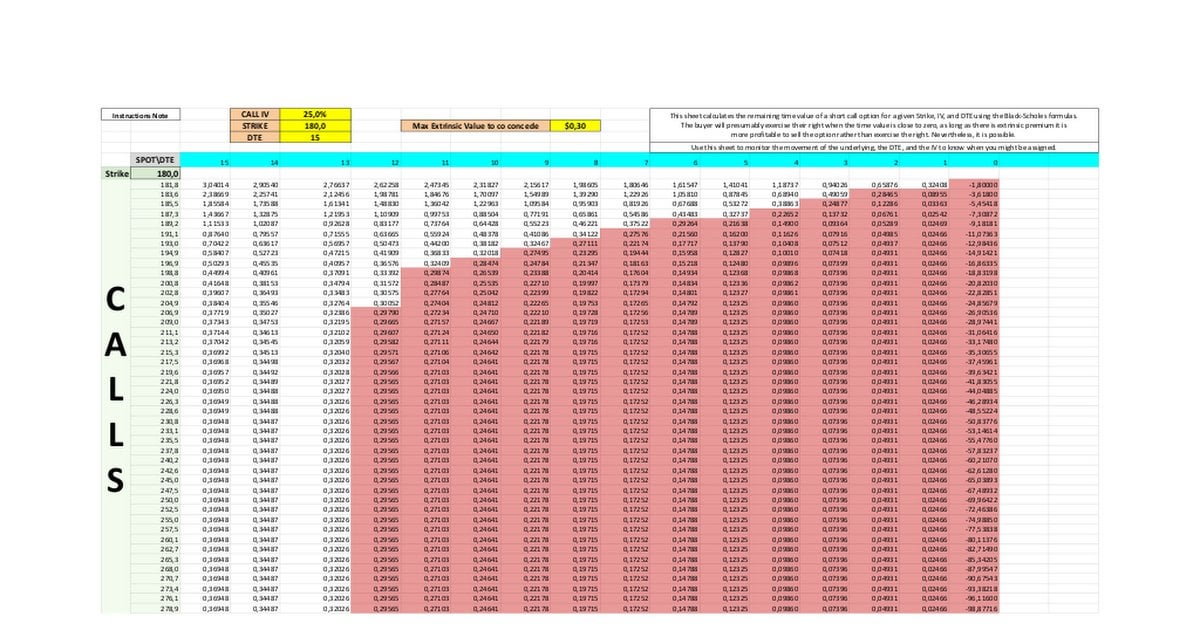

This sheet calculates the remaining time value of a short option for a given Strike, IV, and DTE using the Black-Scholes formulas (No dividends)

The buyer will presumably exercise their right when the time value is close to zero, as long as there is extrinsic premium it is more profitable to sell the option rather than exercise the right. Nevertheless, it is possible

Instructions:

Go to File -> Make a copy

You should only modify these cells.

Inputs:

E1: Enter the IV of the sold Call(update daily)

E2: Enter the strike price of the sale (enter once)

E3: DTE (enter once)

J2: Maximum extrinsic value of the total premium that the buyer would be willing to concede in an early assignment. I use approximately 0.2 – 0.3 ($20-$30), as more than this would mean the buyer is losing that amount, making the assignment unprofitable.

The cells in red indicate the danger zone where early assignment is highly likely given the above conditions.

https://docs.google.com/spreadsheets/d/1tb-0QjYq09Yhn_0W6trYMwRAlnCzIUFTlaW9fnnC0Q8/edit?usp=sharing

Hope it helps

My Extrinsic Value and Assignment Risk Calculator

byu/Defiant_Deer_7076 inoptions

Posted by Defiant_Deer_7076